Case Study Disclosures and Disclaimers

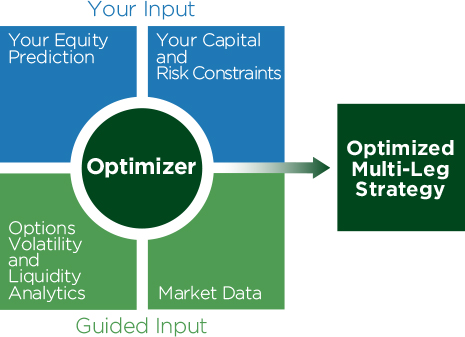

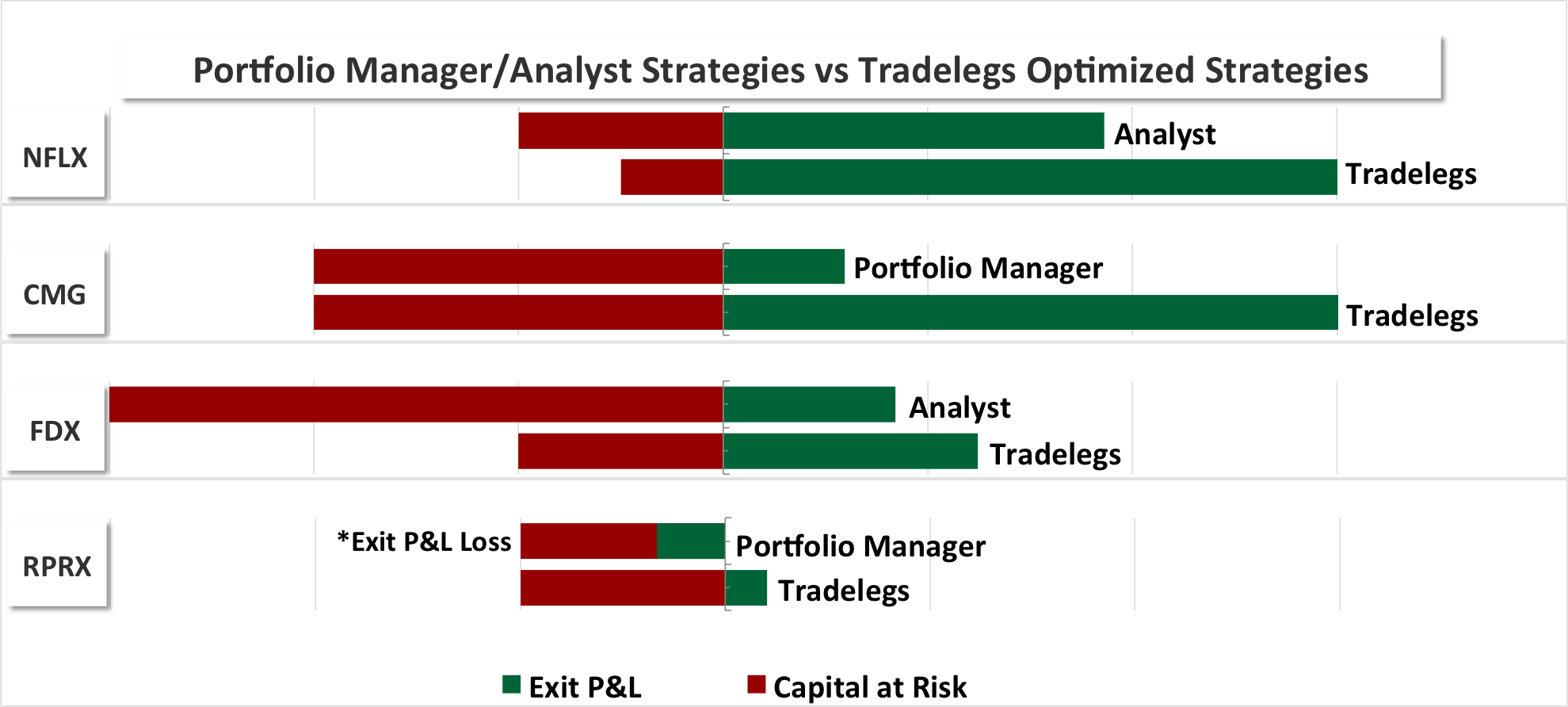

The case studies provided here compare positions generated by a portfolio manager or analyst (the “

Reference Strategy“), as described to Tradelegs by the portfolio manager or analyst or available in publicly accessible materials, with positions generated using the Tradelegs system (the “

Tradelegs Strategy“, “

Tradelegs Optimized Strategy” or “

Proposed Strategy“). All positions in a given case study were based on the same predictions and constraints, and both the Reference Strategy and the Tradelegs Strategy were evaluated under identical conditions, using back-tested, marked-to-market pricing values and the same slippage assumptions.

Although the results described in the Reference Strategies are in some cases based on actual trades, Tradelegs does not and cannot have complete knowledge concerning those trades, including but not limited to exactly when each position described in the case studies was entered and exited. Such information might affect the results achieved by a Reference Strategy. In some cases, the Reference Strategies are not based on actual trades, and so all inputs were hypothetical.

None of the results for the Tradelegs Strategies represent the results of actual trading. The positions described in the Tradelegs Strategies were not executed.

In some cases, the results presented for the Tradelegs Strategies were generated through specific inputs to Derivatives Strategist provided by a representative of Tradelegs, while in others the portfolio manager or analyst who generated the Reference Strategy provided inputs to run on Derivatives Strategist to generate a comparison to his original Reference Strategy. When Tradelegs provided inputs, they were based on Tradelegs’ assessments of the applicable portfolio manager’s or analyst’s predictions and risk tolerance, among other factors. These inputs may not accurately reproduce the manager’s actual predictions, risk tolerance, or other assessments, and they may not correctly reflect the inputs that would have been entered by the portfolio manager. Other inputs may have achieved less successful results.

These case studies are for illustrative purposes only. They are not representative of the results that any particular user of Tradelegs has achieved or will achieve. Users of Tradelegs have had, and are expected to have, materially different results from the results presented here.

The results provided here may not reflect the impact that material economic and market factors might have had on a manager’s decision-making, or on a hypothetical manager’s decision-making, if the manager were actually managing clients’ money.

The conditions, objectives or investment strategies of the portfolio managers and analysts whose results are presented may have changed materially during the time period described in these case studies. The results may not accurately reflect any such changes.

All investments, including investments in options, involve the possibility of loss. There can be no guarantee that by using the Tradelegs system, you will experience profits on your investments or minimize your losses.

The case studies provided do not reflect any reinvestment of earnings in the trading described.

The case studies utilize estimates for fees, expenses, and commissions. The same estimates are used for both the manager’s and Tradelegs’ results. The actual fees, expenses and commissions applicable to a manager’s actual trading may have been lower than the estimates used, which would have resulted in better performance results than those presented in the case studies.

Please also see our standard disclaimers

here.