FDX Case Study – May 2013

Summary

Tradelegs Derivative Strategist™ was used to investigate different ways of expressing a contrarian bearish opinion on FedEx while capping downside risk. The result would have reduced potential worst-case loss by 66% compared to a short equity position.

Note that the strategy generated using Tradelegs was not executed, but was backtested on the same basis as the original reference strategy.

Background

- FDX – FedEx Corporation

- Trade Date: March 11th 2013 / Target Date: May 31st 2013

- General sentiment on FedEx is bullish at the start of March. News has been positive for several weeks and researchers are predicting a price target of +10% to +15% by June 2013

- An analyst disagrees with the prevailing views. He is bearish on FedEx and expects their earnings to fall short of their 2012 numbers. In addition, he is skeptical that their new fuel efficiency initiative will pay off in the near term and thinks their Q2 numbers should be adjusted down

- Tradelegs identifies a strategy that maximizes expected profit if the analyst is right, but is risk-protected if he’s wrong

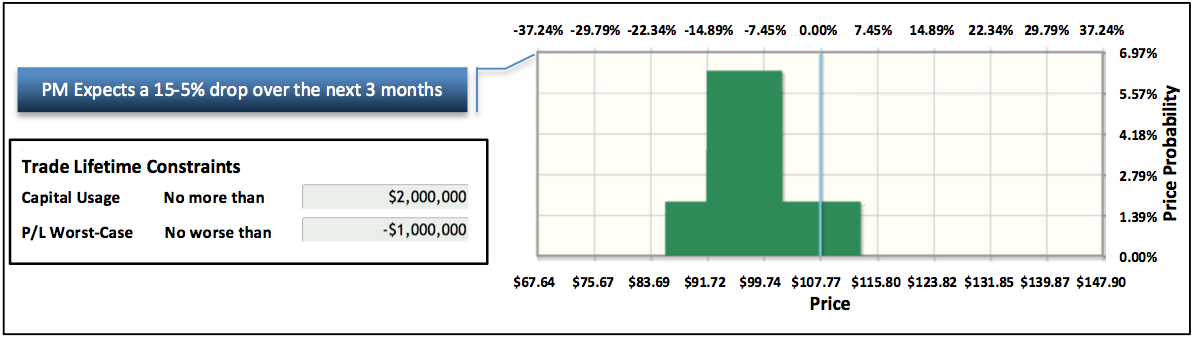

PM Prediction and Constraints

Case Study Results

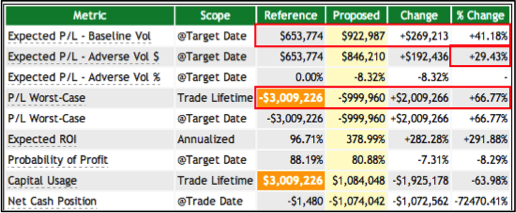

Expected Returns on Trade Date (March 2013)

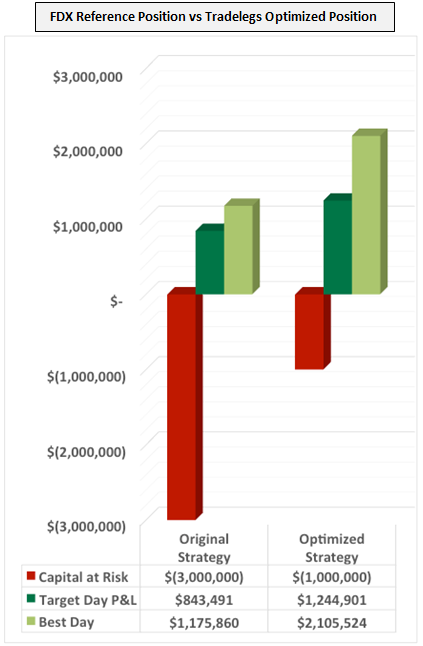

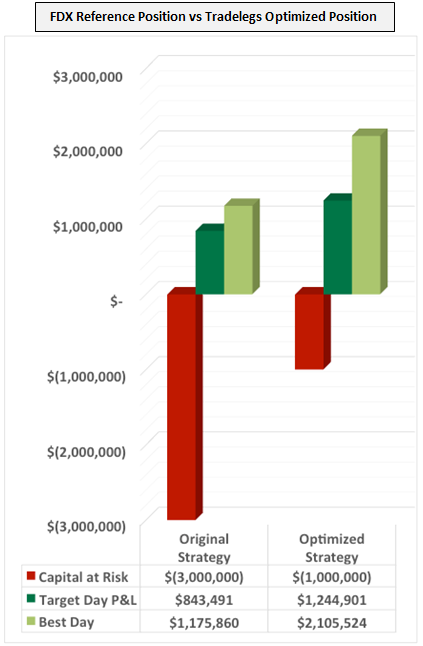

- The Tradelegs Optimized Strategy outperforms the Reference position by an expected average of 41% while reducing potential worst-case loss by 67%

- In this example the analyst wanted to reduce his risk. Tradelegs was used to lower his potential worst-case loss from -$3mm to -$1mm

- The Proposed Strategy is expected to dramatically outperform the Reference under normal and adverse volatility

P&L Payout Curve

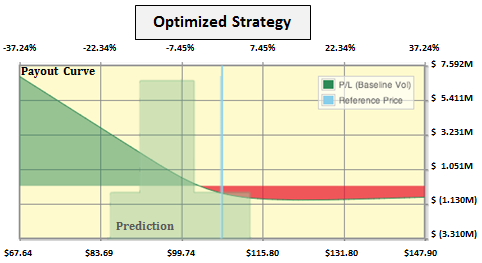

Optimized Strategy

- Maximizes profit in the prediction range

- More accelerated upside

- Caps the downside and actually begins to return towards profitability at ~$130

|

|

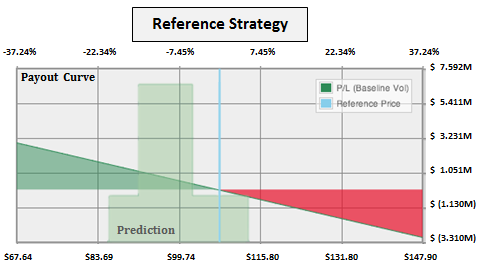

Reference Strategy

- Lower expected average P&L with much higher capital at risk

- The worst-case loss is unlimited beyond the max of the Risk Range

|

|

|

Case Study Conclusions

Actual Backtest Results (May 2013)

- The positions were marked-to-market each day until the Target Date and the Tradelegs Optimized Strategy outperformed the analyst’s Reference strategy by 147% on the Target Date

- The Best Day for the Optimized Strategy outperformed the Reference Strategy by almost 180%

- Throughout the lifetime of the trade the Tradelegs Strategy outperformed the analyst’s Reference Trade on 48 of the 58 days

- Whether you are an occasional options trader or an experienced options strategist, Tradelegs’ advanced decision-support technology can give you a substantial edge over trading unaided

|