RPRX Case Study – October 2013

Summary

This is an event trade on a high-volatility, small-cap stock. The Tradelegs Optimized Strategy increased the expected returns on a fund’s original option strategy almost tenfold, while having the same potential worst-case risk and capital usage. On a marked-to-market basis, the Tradelegs Strategy generated better returns on 29 of the 30 days and ended up profitable, while the Original Strategy incurred a small loss.

Note that the strategy generated using Tradelegs was not executed, but was backtested on the same basis as the original reference strategy.

Background

- RPRX – Repros Therapeutics

- Trade Date: September 9th 2013 / Target Date: October 19th 2013

- Repros Therapeutics [RPRX] is a biotech company focused on endocrine disorders. The company’s lead program has been de-risked by several successful Phase II studies as well as a successful Phase III study. There is one remaining Phase III efficacy study that will be released in October and the outlook is positive

- The Portfolio Manager of an Event-Driven fund put on a trade in an attempt to capture his bullish view on RPRX and protect him against “company-specific trial execution risk”

- We used Tradelegs to identify a better trade with equal or less capital at risk and a lower breakeven point

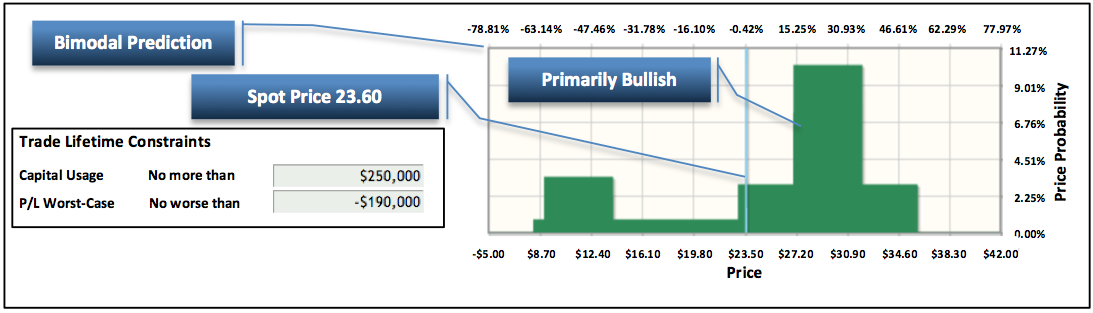

Assumed PM Prediction and Constraints

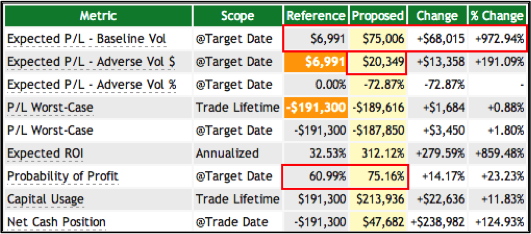

Case Study Results

Expected Returns on Entry (Sep 2013)

- The Tradelegs Proposed Strategy is expected to outperform the fund’s Reference Strategy by an average of 970% under normal volatility conditions, and by an average of 200% under adverse volatility

- The Tradelegs Strategy meets all the fund’s trading constraints — even those that their original trade violated

- The Tradelegs Strategy has almost a 15% higher probability of profit inside the predicted range

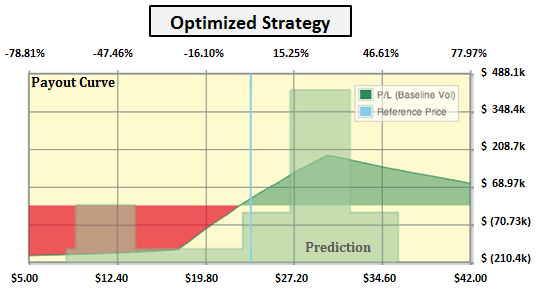

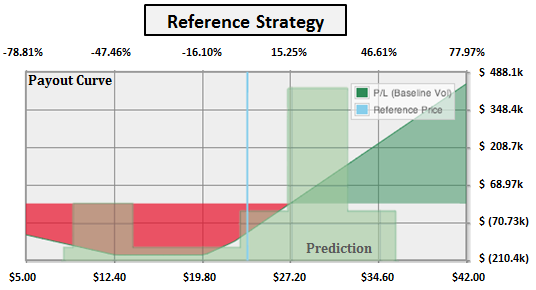

P&L Payout Curve

Optimized Strategy

- Maximizes profit in the prediction range

- Flattens out in the ranges outside the prediction range so that it could capture more profit inside the prediction range

- Offers increased protection should the stock move against the fund, by delaying cross-over to loss

| |

Reference Strategy

- Requires more than a 15% move to break even

- Peaks outside of the prediction

- Accelerated downside slope bottoms out much sooner than the Optimized Strategy

| |

|

Case Study Conclusions

Actual Backtest Results (Oct 2013)

- The positions were marked-to-market each day until the expiration date of the PM’s Reference Strategy

- On the expiration date, the PM’s Reference Strategy lost $63k while the Tradelegs Strategy made a $40k profit

- The Tradelegs Strategy outperformed the fund’s strategy on 29 out of 30 days

- The Tradelegs Optimized Strategy sustained lower losses on the worst performing days of the trade

- In this small-cap, high volatility case study, Tradelegs generated an Optimized Strategy that outperformed a trade from a successful event fund managing over $8b of assets

- Whether you are an occasional options trader or an experienced options strategist, Tradelegs’ advanced decision-support technology can give you a substantial edge over trading unaided

|